|

I wanted to share the recent experience of a client, who was subject to a lengthy audit on the minimum wage. This apparently was a random check, not the result of a complaint.

The client in question is a principled employer and has never intentionally paid under the minimum wage. However being in the hospitality industry they employ many young people. As a result of this, birthdays happen and sometimes, inadvertently, small payroll errors can occur when someone enters a new pay band due to age. These were always rectified as soon as they were discovered. This audit resulted in a great many requests for information from HMRC, for specific pay periods for specific individuals. Many of these went back to previous years. HMRC also wanted to speak personally to a number of employees. Once these questions were answered, HMRC came back repeatedly with more enquiries. My client had nothing whatsoever to hide, but despite this they did come under a fairly sustained interrogation. In terms of person hours, it was a very time-consuming and stressful exercise, with a definite real-terms financial impact. In the end, in frustration and with my help, the client asked HMRC a number of fairly pointed questions, and then (coincidentally or otherwise), the audit was concluded, with no penalties. So what’s the take-home from this? First, do monitor staff birthdays as they relate to minimum wage and make good any accidental errors straight away. If you are audited, do co-operate but if you feel they are not being entirely reasonable, do contact me and I’ll help draft a similar email to the one I recently did. Remember also that furloughed staff (on 80% of pay) can legitimately be paid under the minimum wage because it’s not pay for work.

0 Comments

This week it was announced that an extension to the Job Support Scheme for businesses required to close entirely due to tighter local or national Covid restrictions. Under these proposals, the government will pay two-thirds of wages for businesses forced to close in the coming months.

All you will be painfully aware, Coronavirus is all over the news at the moment. There is an enormous amount of speculation, so I will try to report the issues as they develop and relate to employment in the UK.

As of now, the situation is developing in real time, and there have been some proposed changes to employment rights reported in the media, these include: - Entitlement to SSP from day one (rather than day 4) of sickness - SSP rights for voluntary self-isolation As soon as I know more, I will let you know. Currently, if anyone is actually off sick your normal rules will apply. There is specific Government advice online for those who suspect they may have Coronavirus or may have been exposed to it. Acas has also produced workplace specific guidance (https://www.acas.org.uk/coronavirus) which sets out the steps employers should be taking. If you would like to ask anything specific please give me a call. 1 April 2020 - Increases to national living and minimum wage

The National Living Wage (payable to workers aged 25 and over) will increase from £8.21 to £8.72 The National Minimum Wage will increase as follows: Workers aged 21 to 24 – from £7.70 to £8.20 Workers aged 18 to 20 – from £6.15 to £6.45 Workers aged over compulsory school age under 18 - from £4.35 to £4.55 Apprentices – from £3.90 to £4.15 You are probably sick of politics at the moment but it’s important that I provide some information regarding the forthcoming general election. Should we end up with a Labour Government there are likely to be several fairly major changes to employment law in the UK. I will keep you updated on what these might be, and any timescales involved, when and if the time comes. This is of course hypothetical at this stage, as Labour might not win, but it seems at the moment in politics anything is possible.

The proposed changes under a Labour Government are likely to include: 1. Banning zero hour contracts and making employers issue a contract that reflects the actual hours 2.Removing the separation between employee and ‘worker’ status, which will have a big impact on employment agencies, and also potentially others who use casual workers 3. Having sector-wide collective agreements, which would mean that an employer in a certain sector (e.g. transport, or hospitality) would have to abide by them. In practice I think, under Labour, union membership would increase generally, and it may not matter whether your workplace historically has been ‘unionised’ or not 4. Making major changes to the minimum wage especially for young people with £10 an hour being talked about for those aged over 16 5. Placing a duty on employers to accommodate (rather than consider) flexible working requests In the longer term there is talk of a four-day-week and various other changes. Even though Labour’s message at first glance might seem to be targeted at large employers, most of the proposed changes would affect smaller employers too. As with any election, what a party promises on the campaign trail and what ends up happening can be two quite different things, but I will do my best to keep you updated. There has recently been a court of appeal decision about workers who only work part of the year (for example; term time only or school holidays only) and who are on permanent contracts. It’s to do with the way that holiday pay is calculated. Until now, ACAS guidelines have said that using the standard 12.07% ‘casual worker’ holiday pay calculation is fair for these workers.

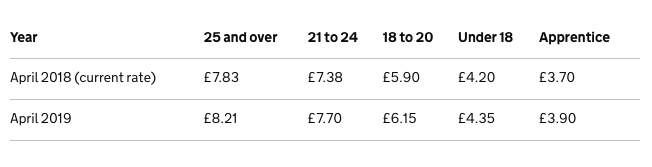

The courts however recently ruled that for workers who only work for part of the year but are on permanent contracts (whether zero hours or not), holiday pay should be calculated on their actual earnings averaged over the previous 12 weeks they’ve worked, ignoring any weeks they didn’t work. The court has also said that such employees are entitled to a full 5.6 weeks holiday a year at their average weekly pay, even though they don’t work for the whole year. In practice this means that, for example, if someone works for 26 weeks a year and earns an average of £300 per week, their total holiday pay entitlement would be £300 (a week’s pay) X 5.6, which equals £1680. Using the 12.07% calculation they would only receive a total of £941.46 holiday pay. This may not affect many clients, however it might affect some. For those that it does, it is likely to have an impact on employment costs. So, if you have any staff who are; 1. On a permanent contract 2. Who only work part of a year Let me know and I’ll talk you through the issues. This doesn't affect normal part-time staff. This ruling only concerns those on permanent contracts who work part of the year (part-year workers). The Court of Appeal noted its ruling could produce odd results in extreme circumstances (for example a cricket coach working one term in a year or exam invigilators only working during exam periods). However, the Court considered that these workers would more likely be engaged on a freelance basis than a permanent contract and so would not be affected by its ruling. In April 2019 the National Minimum Wage rates increases as per the table below. The Real Living Wage foundation estimates the living wage at £9 per hour, and £10.55 in London.

As you may have seen on the news last week, the Supreme Court has ruled employment tribunal fees unlawful, and has abolished them. In fact those who have paid fees will get them refunded. Claimants with genuine claims might even be allowed to make a claim “out of time” if they can show the fees were the reason they did not claim.

Since the fees regime was instigated, claims went down by 70%, so in all likelihood this now means that because there will be no financial barriers to those seeking redress in employment tribunals, the instance of both strong and weaker claims, even pure "fishing expeditions" is highly likely to increase. This means that it’s more important than ever to make sure that the proper processes are followed, not only to avoid actual claims, but also to avoid being tied up in the administrative burden that even a threatened claim can produce. As always, it's invariably cheaper to contact me and ask me whether it's okay for you to do something, rather than contact me and ask me whether it was okay to do the thing that you just did. I hope you are enjoying the summer, weather permitting! I was watching a TED Talk recently and a very important point was made about finding the correct balance between life and technology.

The speaker, Simon Sinek, pointed out the many behaviours that people have with email, text messaging, and social media, particularly in relation to cell phone usage, which in his opinion can amount to an addiction. I highly recommend searching for some of his talks. One of the many examples he gives is that he feels mobile phones should not be present during meetings. Fair enough if they are on silent and in people's pockets, but certainly not placed on the table. He feels that walking into a meeting and placing your phone in front of you on the table sends the signal that the meeting isn't actually that important to you, that you are prepared to answer your phone or respond to a message, rather than give your full attention to the person with whom you are meeting. That's just one small example. But there is one thing he said which really resonated with me, and it was this; "When you don't have your phone, you kind of just enjoy the world." My phone, as a business tool at least, is important to me. Being available for clients is one of the key selling points of my business. My clients know that if I don't answer their call, I'll be getting back to them within a few hours, as soon as my meeting is finished usually, and always on the same day. So when I went on holiday for two weeks it was difficult for me to let go of the concept of being on call. But I did need a holiday. So I planned one. I booked one. I told my clients well in advance. I put in place an emergency plan so they could contact someone in my absence, then I turned my phone off and went on holiday, so I left the phone off for two weeks, locked in the safe in the villa. The world didn't end, there were no emergencies, and when I got back my clients asked me whether I had a nice holiday. Me being out of contact for two weeks didn't cause any problems whatsoever, and I learned an important lesson. But the reason why the above quote about not always having your phone resonated with me is that I have personal experience of it. You see there was another interesting and very beneficial by-product of having my phone switched off. Because I had no phone in my pocket, I had no camera in my pocket. In fact I don't possess a camera apart from the one on my phone. I was staying on a beautiful island with many interesting places to visit and I cannot tell you how liberating it was to arrive at a beauty spot festooned with so many perfect photo opportunities, but without a camera. I watched every other tourist, without fail, arrive at these amazing places and appear to be viewing them completely through their phone; obsessed with taking as many pictures as possible. Sometimes after doing this they just trudged back to the tour bus or the hire car, in a way that seems to me they hadn't really looked properly. I however felt a sense of grounding and presence at these places which I believe I never would have felt had I, like them, had my camera phone with me. Another important lesson. I believe it made my holiday so much better, and let’s face it, who really goes through holiday snaps anyway, apart from to show them to others? Perhaps people are only really taking the pictures to put them online to show all their friends what a lovely time they had. So remember, next time you’re going to do something amazing, or go somewhere beautiful; don’t take your phone, just kind of enjoy the world. Most employers will have noticed the news stories recently about companies such as Uber and Pimlico Plumbers losing tribunal cases where people whom firms considered were self-employed turn out to be 'workers/employees' in the eyes of the law.

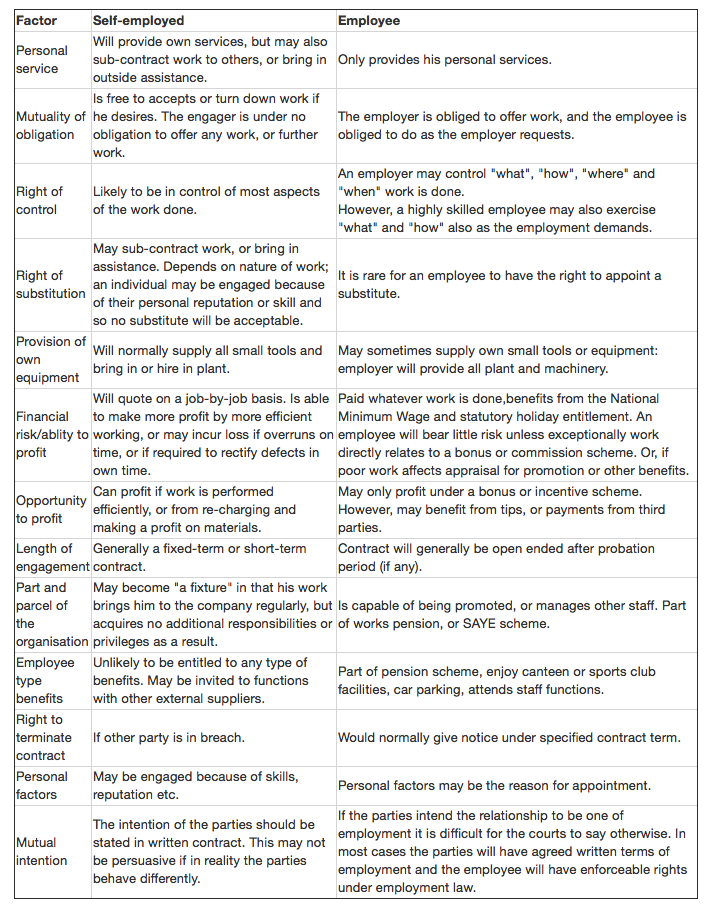

The law will always look at the reality of any relationship between an individual performing services and the hiring firm. In a nutshell therefore, whatever you have in writing saying someone is self-employed, doesn't necessarily mean they are. Each case is assessed on its merits, so I can't give absolute advice here, but here are some useful guidelines to help understand the way the relationship is assessed. In addition to the information below, it's also worth asking whether the person you are engaging to perform self-employed services is A; actually in business in their own right (although they do not have to be a Ltd company), B; whether they have an identifiable brand (i.e. a trading name, a website etc.) and C; whether they have a range of other clients. Any arrangement which holds itself out to be a self-employed situation but in every other way looks like an employed relationship, for example purely for the hiring firm to avoid the legal obligations of employment and the service provider to have a few tax advantages, then it may well be that the law will say that it is not legitimate self-employment. |

AuthorNews and (we think) useful advice from Duncan Elliott, Archives

July 2021

Categories |

RSS Feed

RSS Feed