|

Most employers will have noticed the news stories recently about companies such as Uber and Pimlico Plumbers losing tribunal cases where people whom firms considered were self-employed turn out to be 'workers/employees' in the eyes of the law.

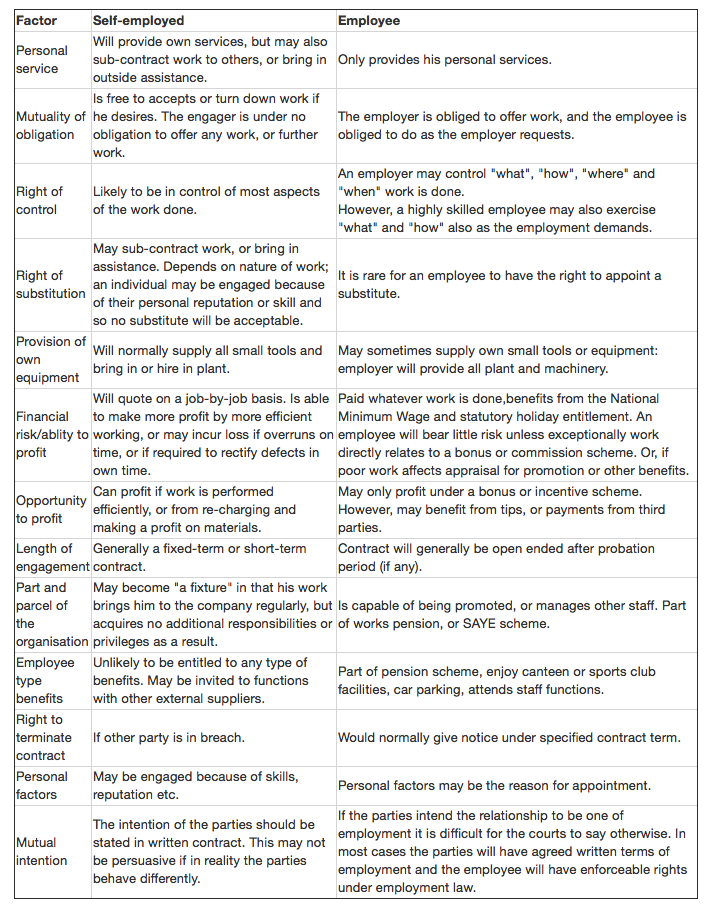

The law will always look at the reality of any relationship between an individual performing services and the hiring firm. In a nutshell therefore, whatever you have in writing saying someone is self-employed, doesn't necessarily mean they are. Each case is assessed on its merits, so I can't give absolute advice here, but here are some useful guidelines to help understand the way the relationship is assessed. In addition to the information below, it's also worth asking whether the person you are engaging to perform self-employed services is A; actually in business in their own right (although they do not have to be a Ltd company), B; whether they have an identifiable brand (i.e. a trading name, a website etc.) and C; whether they have a range of other clients. Any arrangement which holds itself out to be a self-employed situation but in every other way looks like an employed relationship, for example purely for the hiring firm to avoid the legal obligations of employment and the service provider to have a few tax advantages, then it may well be that the law will say that it is not legitimate self-employment.

1 Comment

|

AuthorNews and (we think) useful advice from Duncan Elliott, Archives

July 2021

Categories |

RSS Feed

RSS Feed